Efficient Debt Collection by Credifin: Solutions That Job

Wiki Article

Collection Specialists: Specialist Lending Recuperation Solutions

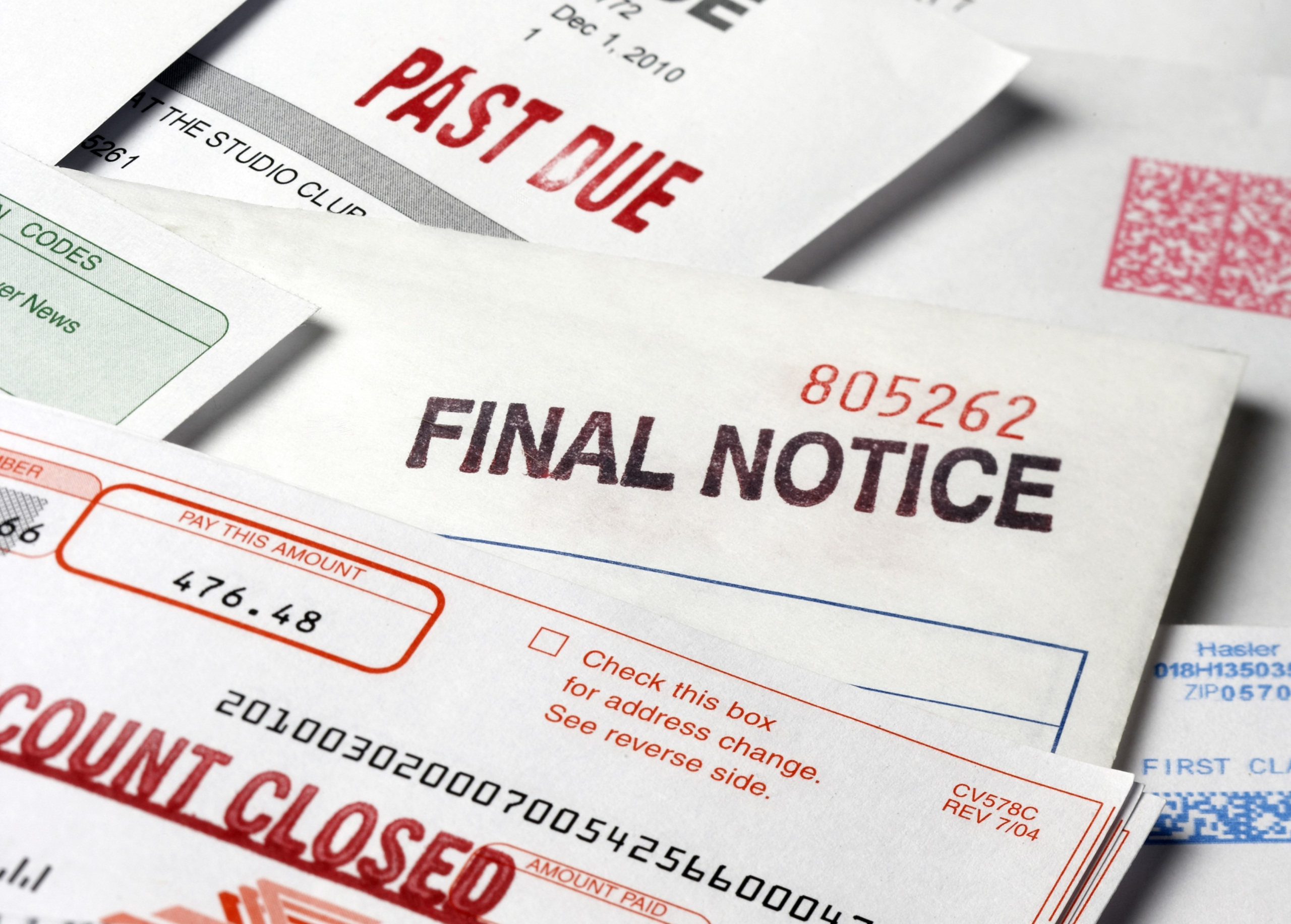

Are you having a hard time to recover fundings that have gone overdue? Look no more! Our post on "Collection Specialists: Specialist Loan Recovery Solutions" will certainly provide you with the insight you require to understand the importance of working with expert collection experts. You'll discover the car loan recovery procedure and also discover efficient methods for recouping your fundings. Do not let unpaid finances weigh you down any longer-- let our experts guide you to success.The Value of Expert Collection Specialists

You need to understand the value of employing professional collection specialists for effective car loan recovery solutions. When it concerns recovering fundings, it can be a time-consuming and also challenging procedure. That's why it's necessary to have experts that concentrate on this field. Professional collection experts have the understanding and experience to deal with the ins and outs of loan healing properly.

Among the primary reasons employing expert collection specialists is essential is their know-how in dealing with delinquent customers. These specialists are skilled in the legislations as well as regulations surrounding financial obligation collection, making certain that all actions taken are within lawful limits. They understand the right techniques to use when communicating with customers, boosting the chances of successful healing.

Additionally, expert collection experts have accessibility to advanced innovation and resources that can simplify the finance recuperation procedure. They make use of specialized software application and also devices to track and also manage overdue accounts efficiently. credifin. This aids in recognizing prospective dangers, developing personalized recuperation strategies, and optimizing the chances of effective results

Additionally, by contracting out financing recuperation to experts, you can save valuable time and also sources. Instead of dedicating your very own personnel to ferret out delinquent borrowers, you can concentrate on core company procedures while the collection experts deal with the recuperation procedure.

Understanding the Funding Recovery Refine

Understanding the loan recovery process can be simplified by breaking it down into workable steps. You need to collect all the necessary info about the debtor and also the finance.The next action is to speak to the customer as well as review the impressive lending. It's essential to be reasonable but strong throughout this conversation, explaining the consequences of non-payment and also providing possible services. You can bargain a settlement strategy that functions for both events if the consumer is cooperative. You may require to rise the scenario by sending official demand letters or engaging a collection firm if the borrower is unwilling or less competent to coordinate.

Throughout the finance recuperation process, it's important to record all interaction and also actions taken. If legal action becomes needed, this will certainly assist you maintain track of progression and also offer evidence. Once the loan has actually been completely paid back, it's essential to shut the case as well as upgrade all appropriate documents.

Techniques for Efficient Finance Healing

Throughout the car loan recuperation procedure, it's critical to preserve open lines of interaction with the customer. By remaining in touch as well as maintaining the lines of interaction open, you can make certain a smoother and extra reliable recovery process.Along with routine interaction, it's additionally crucial to listen to the debtor's perspective and also understand their scenario. By revealing empathy and also understanding, you can construct trust fund as well as rapport, which can go a lengthy method in settling the loan healing. Listen and client, enabling the borrower to express their issues or supply potential solutions. This open and considerate discussion can usually result in equally helpful agreements and resolutions.

On the whole, maintaining open lines of communication throughout the financing recuperation process is essential for Home Page an effective outcome. It aids develop trust, urges participation, and enables a much better understanding of the customer's circumstance. Remember, reliable communication is crucial to solving any type of issues and making certain a positive result.

Perks of Hiring Professional Collection Specialists

When working with experienced professionals to handle collections, you can gain from their expertise and also understanding in resolving overdue accounts successfully. These professionals recognize the details of the collection process and also can navigate with it with convenience. With their years of experience, they have established effective techniques to bring and also recover impressive financial obligations in the repayments that are owed to you.One of the essential advantages of working with collection professionals is their capability to interact efficiently with borrowers. They have actually refined their settlement skills and also know exactly how to come close to borrowers in a manner that motivates them to do something about it as well as pay. Their influential strategies as well as understanding of borrower psychology can dramatically raise the opportunities of successful debt healing.

In addition, collection experts are well-versed in the laws as well as policies bordering debt collection. They remain updated on any kind of modifications in regulations and are knowledgeable concerning the legal civil liberties as well as responsibilities of both the lender and the borrower. This makes certain that the collection procedure is carried out morally and within the limits of the law.

By outsourcing your collection efforts to specialists, you can conserve time and also sources that would otherwise be invested on training and handling an in-house group. Debt collection agency have the required framework and innovation to efficiently track as well as take care of delinquent accounts. They use innovative software application and also analytics to simplify the collection and prioritize procedure, optimizing your chances of recovering arrearages.

Ensuring Compliance in Financing Recovery Practices

One vital element of conformity is comprehending and carrying out the Fair Financial debt Collection Practices Act (FDCPA). This government legislation outlines the standards as well as limitations that debt collection agency should follow when attempting to recuperate financial debts. Familiarize yourself with the FDCPA and also make sure that your group is educated on its requirements. This will certainly assist you avoid any violations that can lead to costly lawful repercussions.

Furthermore, it's important to keep an eye on any type of modifications or updates to state and neighborhood laws, as they may differ from the government guidelines. These guidelines can consist of licensing requirements, rate of interest limitations, as well as specific collection techniques. Staying notified concerning these guidelines will certainly aid you navigate the complexities of lending recovery and make certain that you're complying with anchor the ideal treatments.

Consistently assessing your inner policies and also procedures is likewise crucial for conformity. Ensure that your team is trained on the protocols as well as standards click for info you have in area. Routinely audit your processes to identify any locations that require renovation or adjustment. By constantly keeping an eye on and updating your methods, you can keep compliance in your car loan recovery efforts.

Conclusion

So, if you're aiming to recoup financings in one of the most effective as well as compliant way feasible, hiring specialist collection specialists is the way to go. credifin. They have the knowledge and also skills to navigate the financing recuperation procedure effectively, using tested strategies to take full advantage of outcomes. By outsourcing this job to professionals, you can concentrate on various other essential aspects of your organization while ensuring that your finance recuperation practices remain in line with regulations. Don't hesitate to buy the know-how of collection professionals for an effective lending recovery journey.

Furthermore, specialist collection specialists have access to sophisticated technology as well as sources that can enhance the loan recovery procedure.

Report this wiki page